How to Get Funding Without Taking Out Student Loans

Pursuing higher education is a significant investment, and the prospect of accumulating substantial student loan debt can be daunting. Fortunately, numerous avenues exist to finance your education without resorting to loans. This article explores various strategies for securing funding, focusing on scholarships, grants, work-study programs, and creative fundraising approaches. We'll delve into the eligibility requirements for each option, provide practical tips for maximizing your chances of success, and highlight lesser-known resources that can help you achieve your academic goals debt-free. Discover how strategic planning and diligent effort can pave the way for an affordable and rewarding educational experience.

How to Get Funding Without Taking Out Student Loans

Navigating the landscape of higher education financing can be daunting, especially when the specter of student loan debt looms large. Fortunately, there are viable alternatives to consider that can help you achieve your academic goals without incurring substantial debt. The key lies in proactive research, strategic planning, and a willingness to explore diverse funding sources. These approaches involve a combination of merit-based aid, need-based assistance, and creative financial strategies that prioritize minimizing long-term financial burden. Exploring these pathways requires dedication, persistence, and a comprehensive understanding of the available resources.

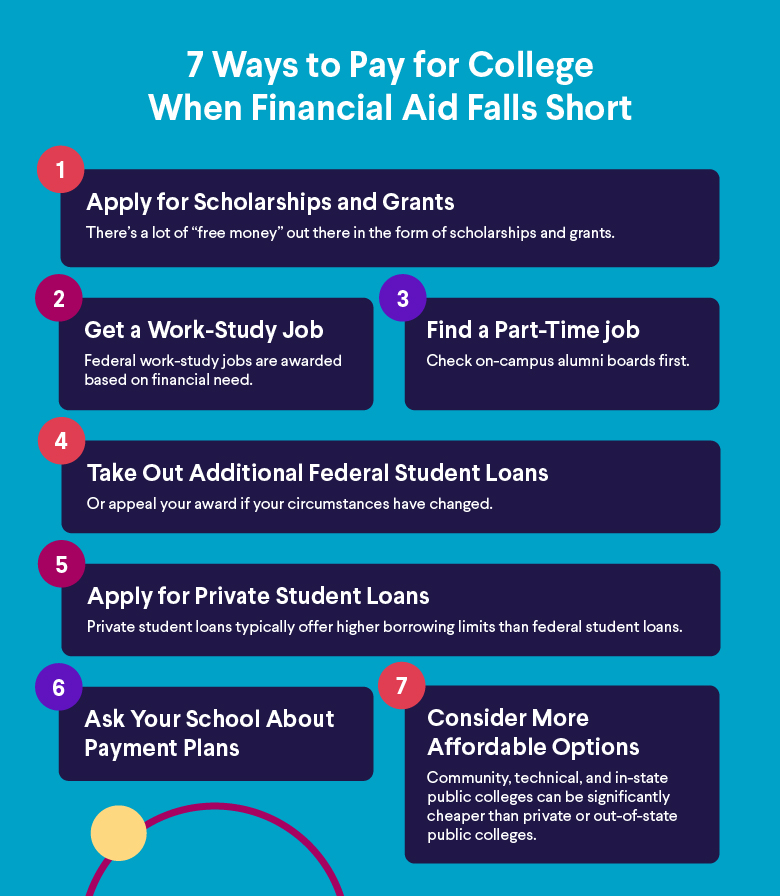

Explore Scholarships and Grants

Scholarships and grants represent a cornerstone of debt-free college funding. These are essentially free money awarded based on academic merit, financial need, specific talents, or affiliations. Begin your search early and exhaustively, utilizing online databases, high school guidance counselors, and college financial aid offices. Target both broad-based and niche scholarships that align with your profile and interests. Remember to meticulously follow application instructions and craft compelling essays that highlight your strengths and aspirations.

Consider Work-Study Programs

Work-study programs offer a valuable opportunity to earn money while pursuing your education. These programs provide part-time jobs, often on campus, that are specifically designed to accommodate students' academic schedules. Earnings from work-study can be used to cover living expenses, tuition fees, or other educational costs. Work-study positions also offer valuable work experience that can enhance your resume and increase your employability after graduation. Be sure to inquire about work-study eligibility during the financial aid application process.

Seek Tuition Reimbursement from Employers

Many employers offer tuition reimbursement programs as an employee benefit. These programs can help cover the cost of college courses or degree programs that are relevant to your job or career goals. Check with your current employer or prospective employers to determine if they offer tuition assistance. If so, carefully review the eligibility requirements and application procedures. Tuition reimbursement can be a significant source of funding, especially for students pursuing continuing education or career advancement.

Attend Community College First

Starting your academic journey at a community college can significantly reduce your overall college expenses. Community colleges typically offer lower tuition rates than four-year universities, allowing you to complete your general education requirements at a fraction of the cost. After completing your associate's degree, you can then transfer to a four-year university to complete your bachelor's degree. This strategy can save you thousands of dollars in tuition fees without compromising the quality of your education.

Negotiate with the College's Financial Aid Office

Don't hesitate to negotiate with the college's financial aid office if you feel your financial aid package is insufficient. Provide documentation of any extenuating circumstances, such as unexpected medical expenses or a change in your family's income. College financial aid officers have the discretion to increase your aid package based on your individual needs. Approach the negotiation process respectfully and professionally, presenting a clear and well-documented case for additional assistance.

| Funding Source | Description | Benefits | Considerations |

|---|---|---|---|

| Scholarships & Grants | Free money awarded based on merit, need, or other criteria. | Reduces the overall cost of education; doesn't need to be repaid. | Highly competitive; requires diligent searching and strong applications. |

| Work-Study Programs | Part-time jobs, often on campus, for eligible students. | Provides income while in school; offers valuable work experience. | Limited availability; earnings may not cover all expenses. |

| Tuition Reimbursement | Employer-sponsored programs that cover the cost of education. | Reduces or eliminates the need for loans; benefits career advancement. | Requires meeting employer eligibility requirements; may be tied to specific courses or degrees. |

| Community College | Two-year colleges with lower tuition rates. | Reduces the cost of general education requirements; allows for transfer to a four-year university. | May require transferring credits; may not offer all desired academic programs. |

| Negotiating with the Financial Aid Office | Appealing for additional financial aid based on individual circumstances. | Potential for increased aid package; demonstrates proactivity and communication skills. | Requires strong documentation; success is not guaranteed. |

https://youtube.com/watch?v=rdOORpvX0zc%26pp%3D0gcJCfcAhR29_xXO

Can you still get a grant without completing the FAFSA?

Understanding Institutional Grants

Many colleges and universities offer their own grants using their institutional funds. In some cases, these grants may not require the FAFSA. However, it's crucial to understand that these opportunities are limited, and they often come with specific eligibility criteria.

- Research the financial aid policies of the colleges you are considering. Contact the financial aid office directly to inquire about institutional grant programs and their requirements.

- Check if the college requires a separate application for institutional grants. This might involve providing financial information directly to the institution.

- Be aware that funding is limited, and institutional grants are often awarded on a first-come, first-served basis or based on specific criteria like academic merit or demonstrated need.

Exploring Private Grants and Scholarships

Private grants and scholarships are offered by various organizations, foundations, and companies. These can be a valuable alternative to federal and state aid, and many do not require the FAFSA.

- Use online search engines and databases like Scholarships.com, Fastweb, and Sallie Mae's Scholarship Search to find relevant grants and scholarships.

- Look for grants and scholarships that match your background, interests, or field of study. Many organizations offer funding for students pursuing specific degrees or belonging to certain groups.

- Pay attention to eligibility requirements and deadlines. Each grant or scholarship has its own set of rules and deadlines, so read the instructions carefully before applying.

Employer-Sponsored Tuition Assistance

Some employers offer tuition assistance programs to their employees or their dependents. This can be a significant source of funding for education, and it typically does not involve the FAFSA.

- Check with your employer or your parents' employers to see if they offer tuition assistance benefits.

- Understand the eligibility requirements and any restrictions on the types of courses or programs that are covered.

- Be aware that some employers may require you to remain employed with the company for a certain period after completing your education to avoid having to repay the tuition assistance.

State-Specific Grant Programs (Limited)

While most state grant programs require the FAFSA, there might be a few niche programs or specialized grants that have alternative application processes. These are usually very specific in their target audience.

- Research your state's higher education agency to see if they offer any grant programs that do not require the FAFSA.

- Look for programs that target specific populations, such as students pursuing certain careers, those with disabilities, or those from underserved communities.

- Be prepared to provide detailed financial information and other documentation as required by the program.

Understanding the Drawbacks

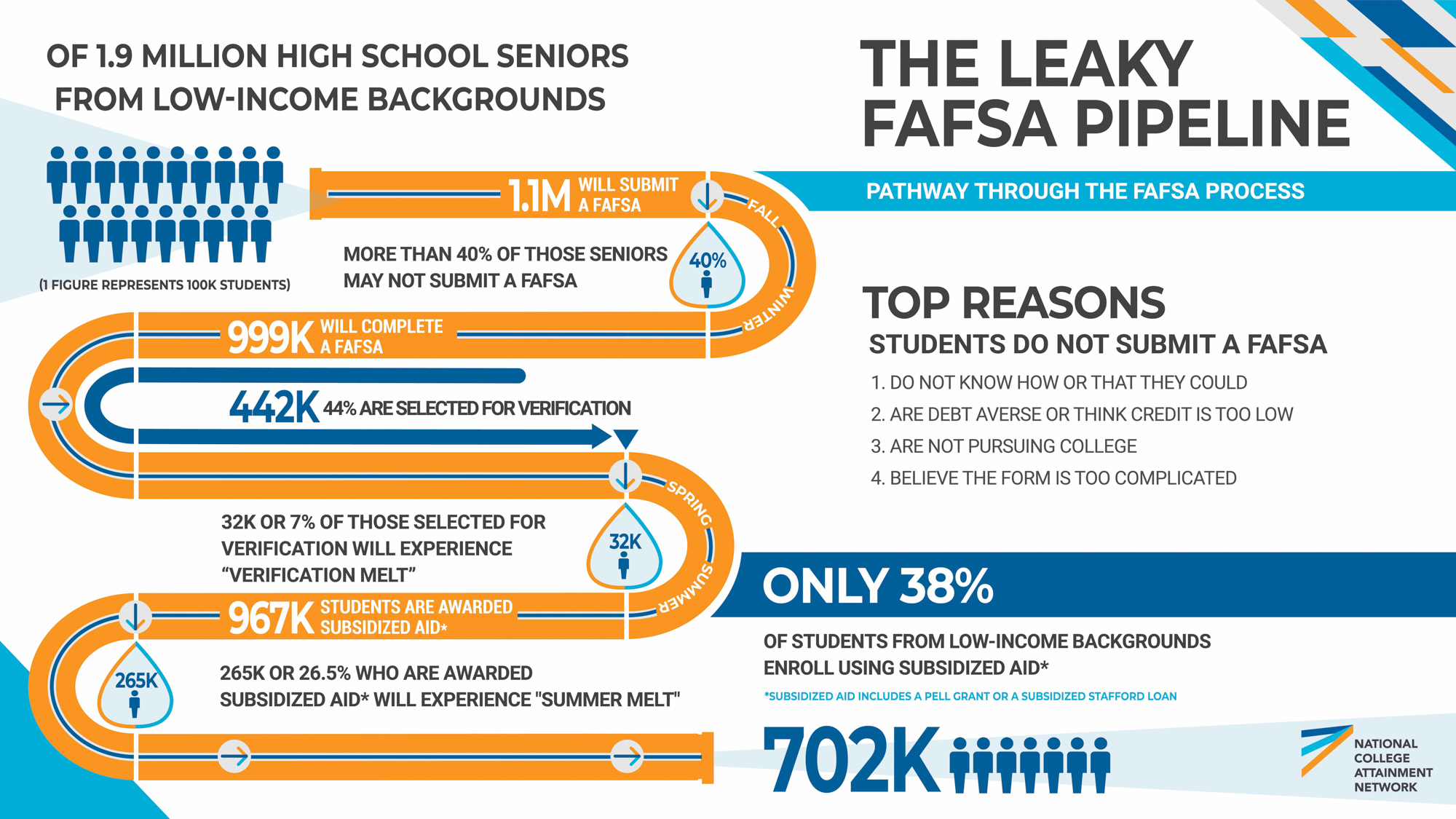

While it's possible to get a grant without completing the FAFSA, it's important to understand the disadvantages. You will be missing out on a significant amount of potential aid, including federal grants like the Pell Grant and state-based grants.

- You will not be eligible for federal student loans, which may be necessary to cover the cost of education.

- You may have to rely more on private student loans, which often have higher interest rates and less favorable repayment terms.

- You may miss out on other forms of financial aid that are awarded based on FAFSA data, such as work-study programs and some institutional scholarships.

Frequently asked questions

What are some alternative funding sources besides student loans?

Grants and scholarships are excellent sources of free money for college, requiring no repayment. Explore opportunities like Pell Grants, state grants, and private scholarships based on merit, need, or specific criteria. Additionally, consider work-study programs that allow you to earn money while attending school, effectively reducing your overall tuition costs.

How can I improve my chances of receiving scholarships?

To improve your scholarship prospects, start by maintaining a strong academic record and participating in extracurricular activities to showcase your skills and interests. Tailor your applications to each scholarship's requirements, highlighting relevant experiences and writing compelling essays that demonstrate your passion and goals. Utilize online scholarship search engines and network with teachers, counselors, and community members for leads on local and national opportunities.

Are there any income-sharing agreements (ISAs) as funding options?

Yes, income-sharing agreements (ISAs) are an alternative funding model where you receive money for education in exchange for paying a percentage of your future income for a set period. Unlike student loans, repayments are tied to your earnings, providing some financial protection if you experience periods of low income or unemployment. Research reputable ISA providers and carefully assess the terms and conditions before committing to this option.

How does working during college help reduce the need for student loans?

Working while in college can significantly reduce your reliance on student loans by providing a steady stream of income to cover tuition, living expenses, and other related costs. Consider part-time jobs on campus, internships in your field of study, or freelance work to gain valuable experience while earning money. Effective time management and balancing work with academics are crucial for success in both areas.